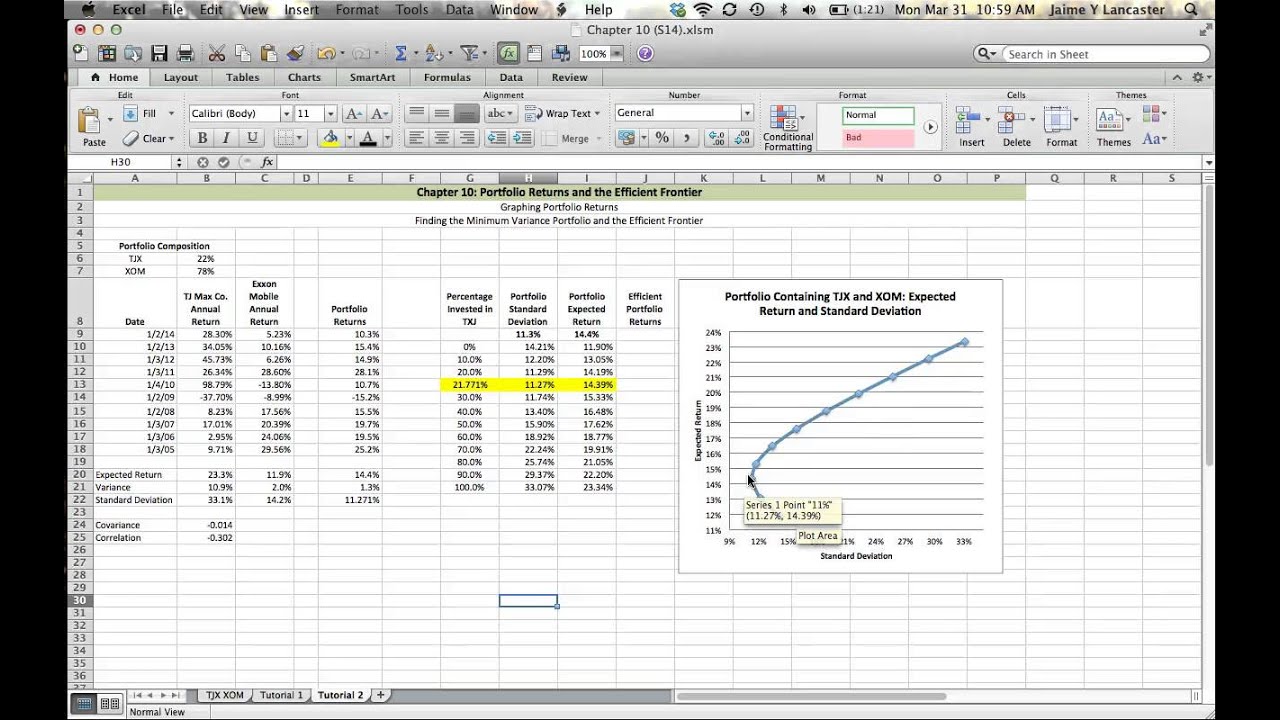

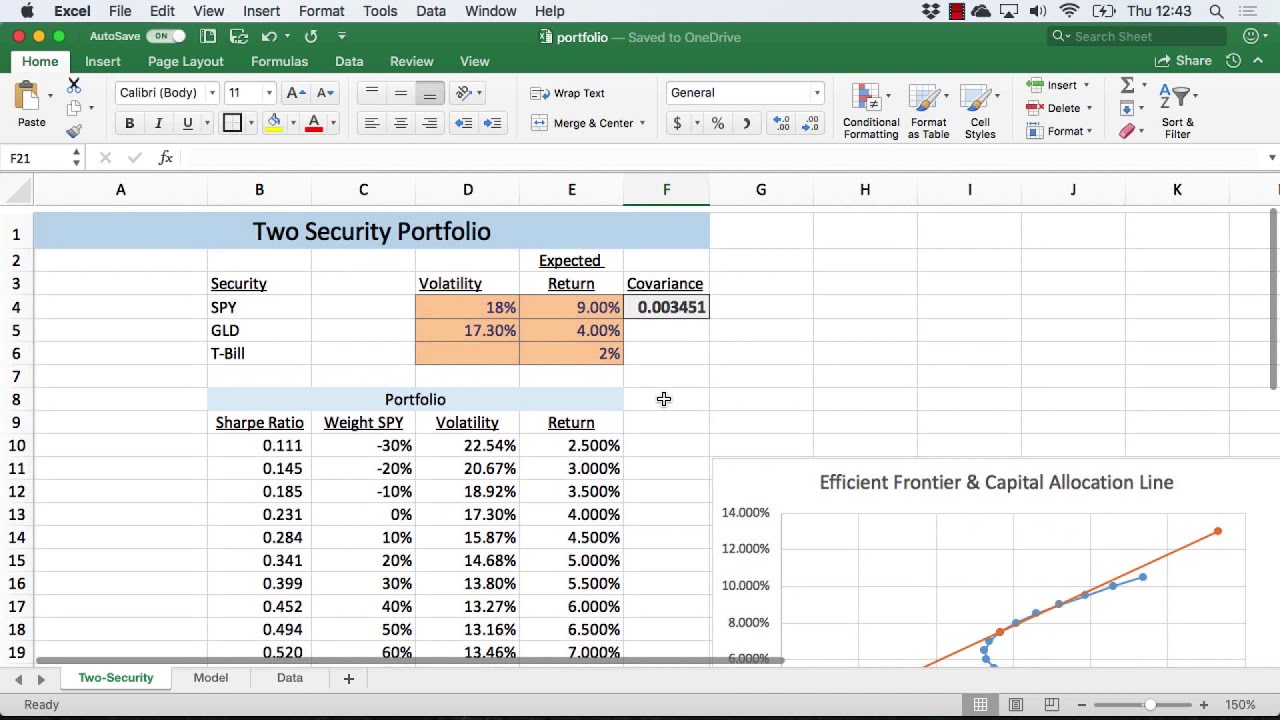

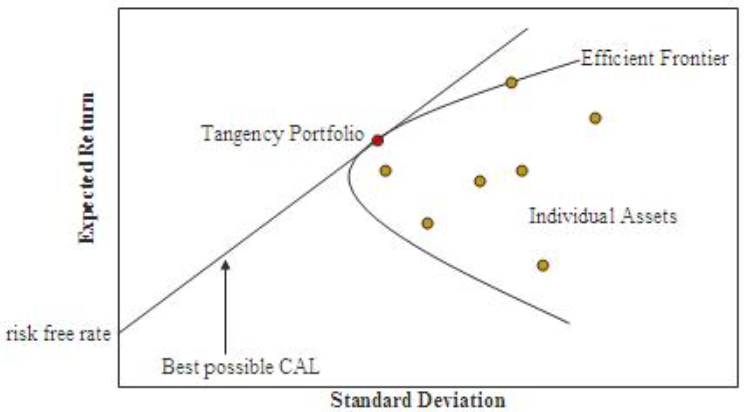

11.5 Efficient portfolios with two risky assets and a risk-free asset | Introduction to Computational Finance and Financial Econometrics with R

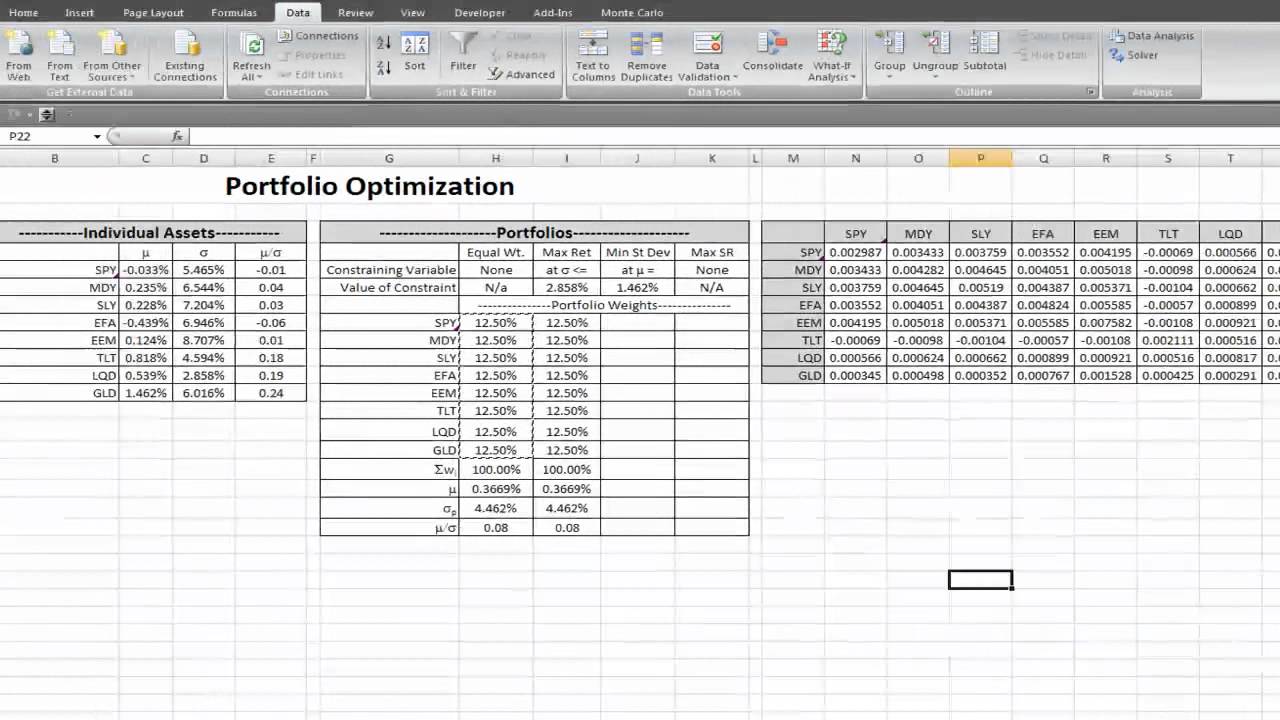

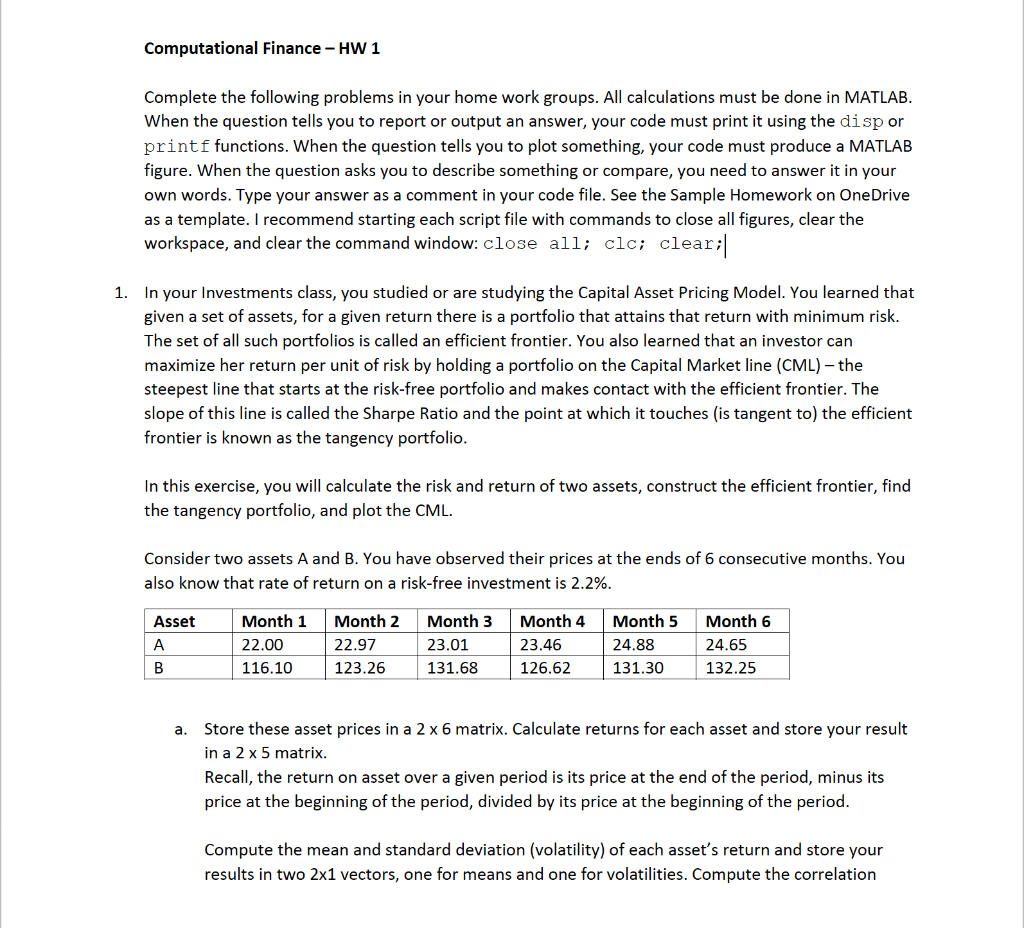

Portfolio Optimization with Many Risky Assets — Econ 133 - Security Markets and Financial Institutions

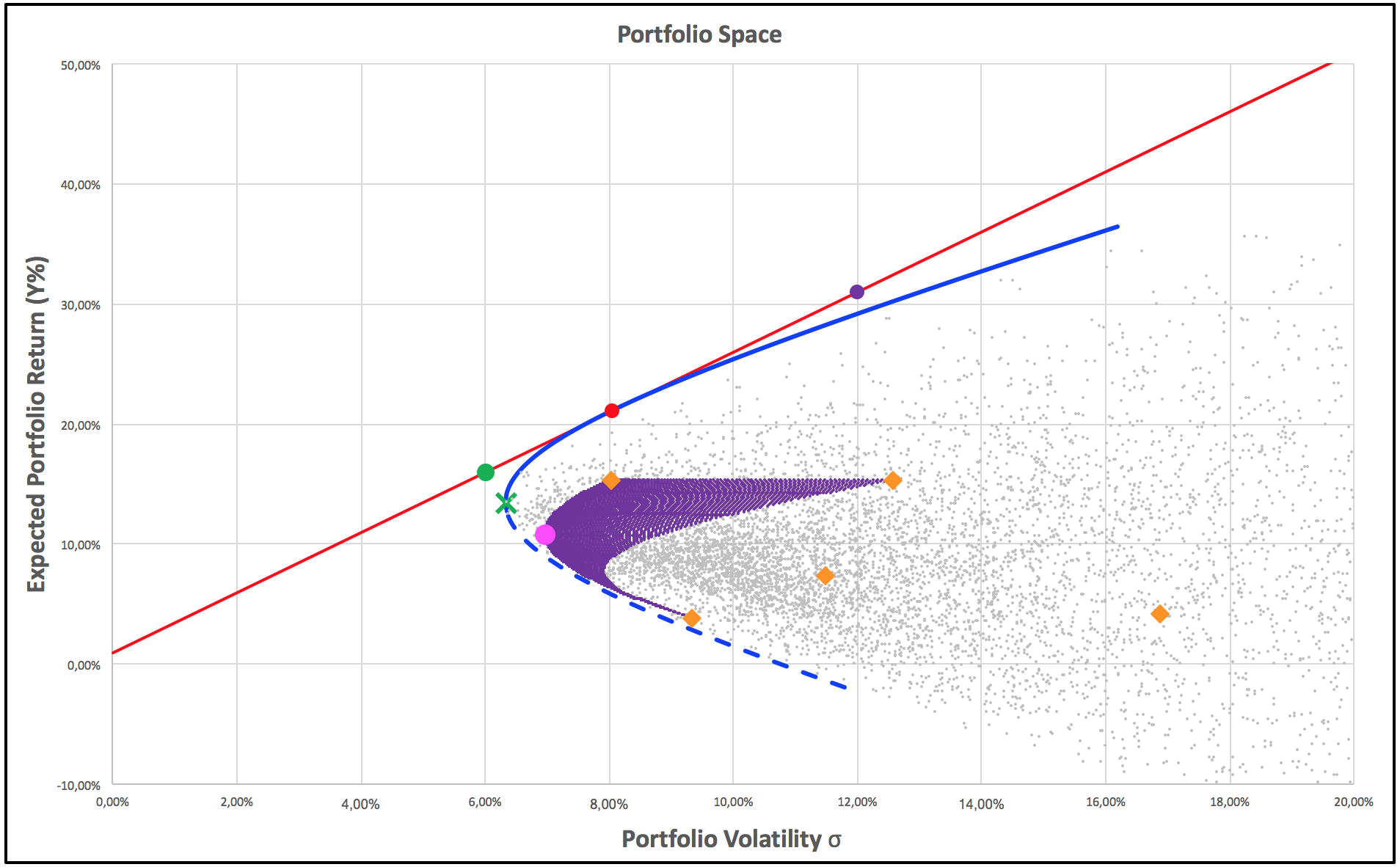

How To Estimate Optimal Stock Portfolio Weights Using Monte Carlo Simulations & Modern Portfolio Theory | by Zhijing Eu | Analytics Vidhya | Medium

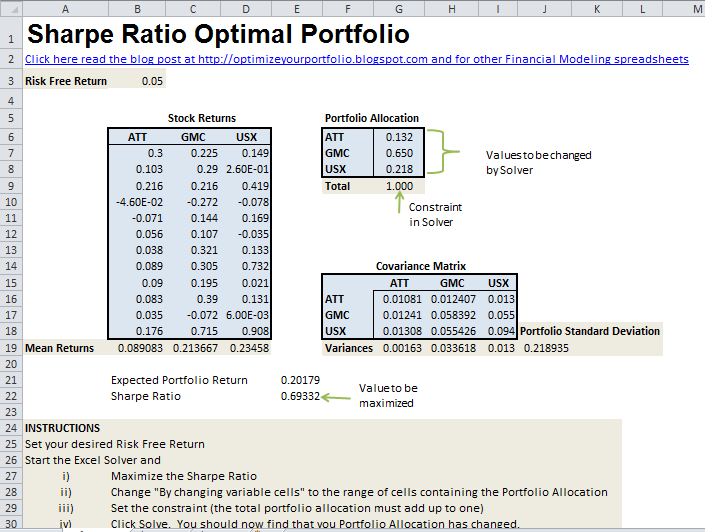

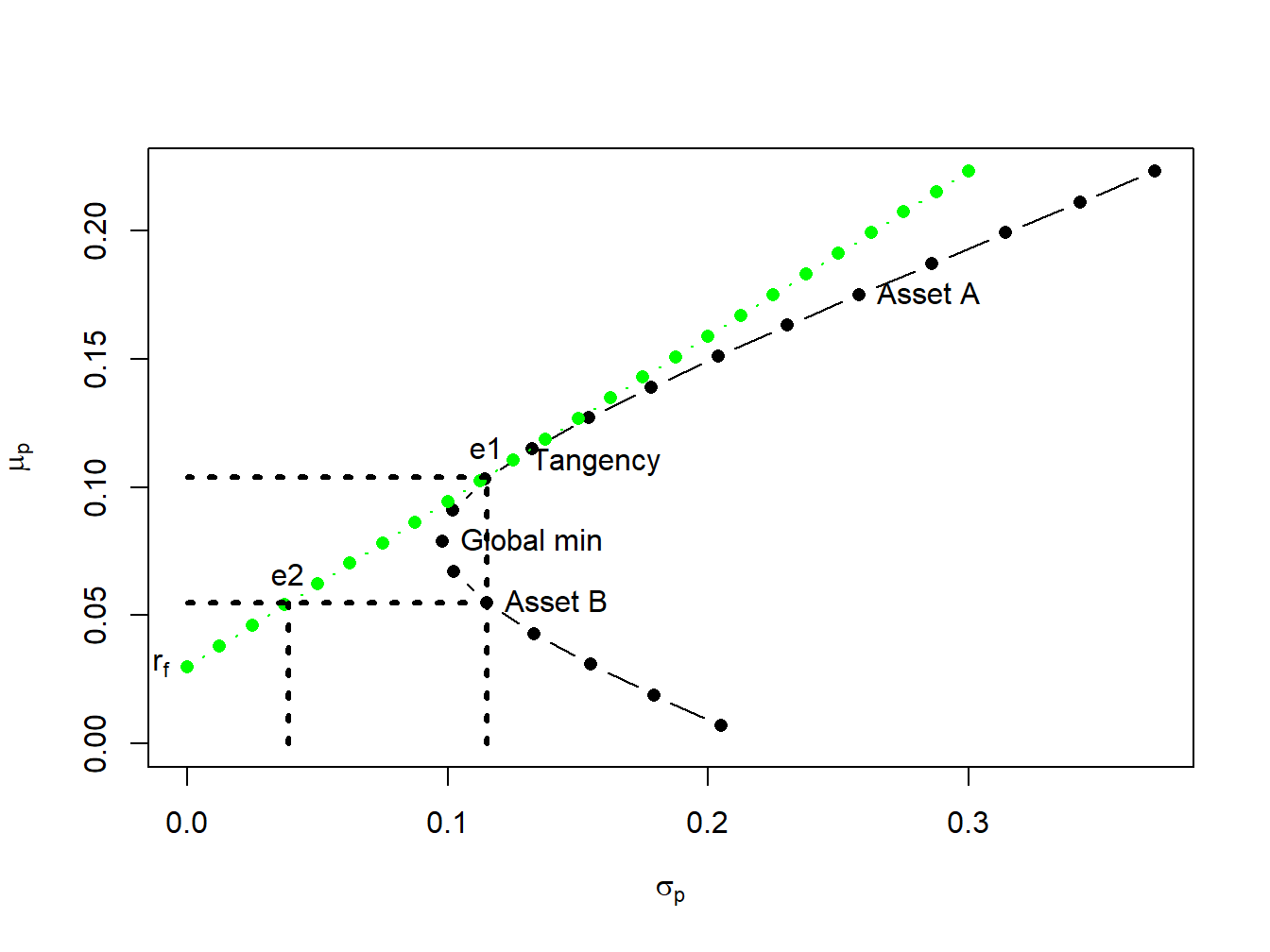

python - Compute tangency portfolio with asset allocation constraints - Quantitative Finance Stack Exchange

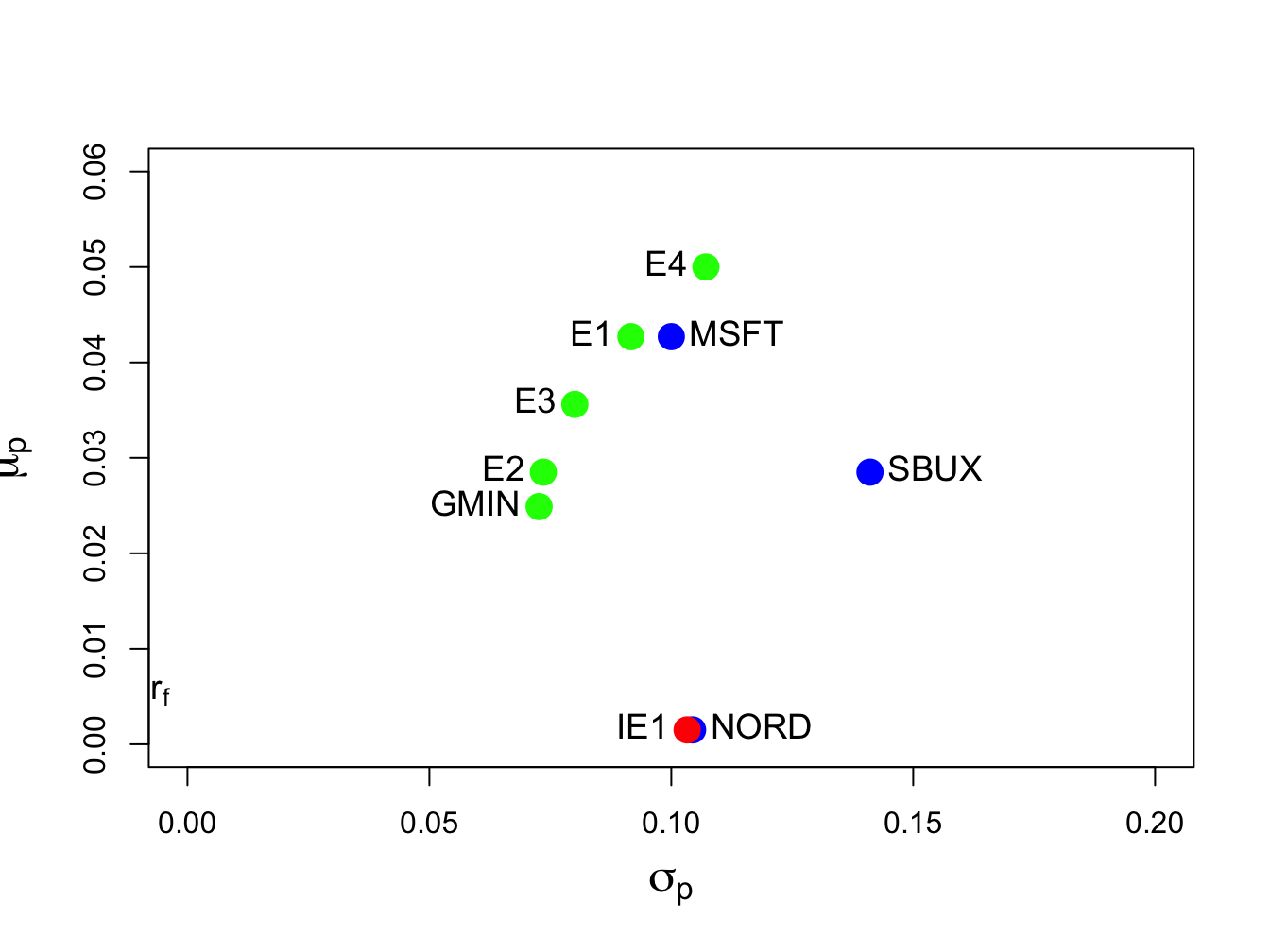

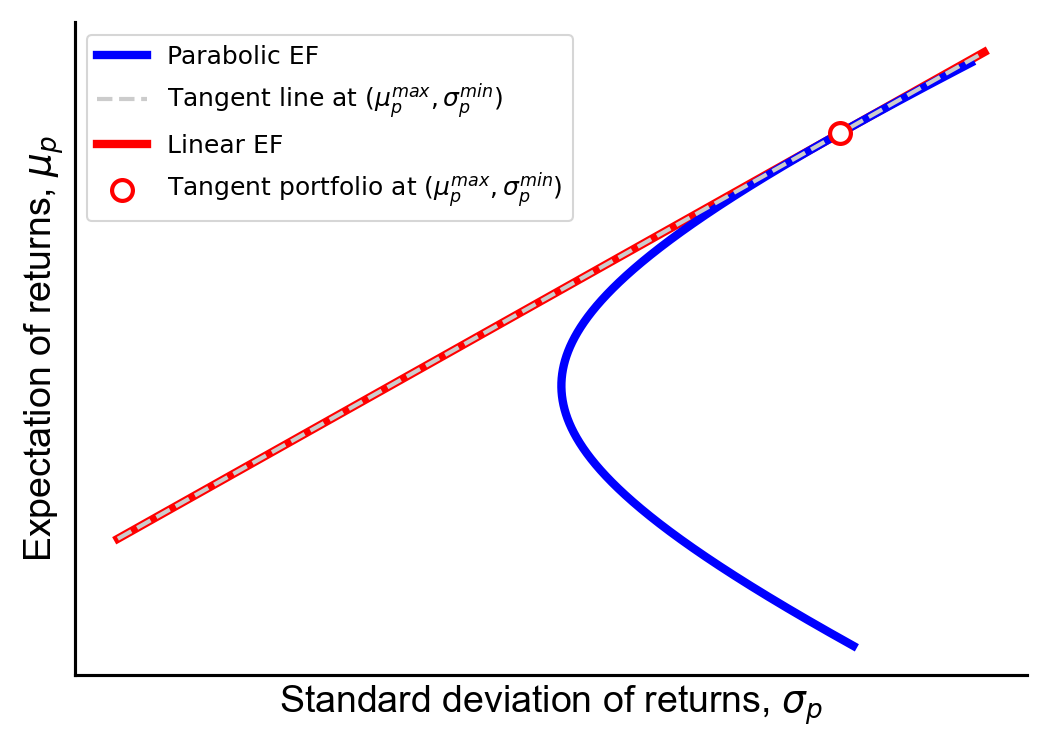

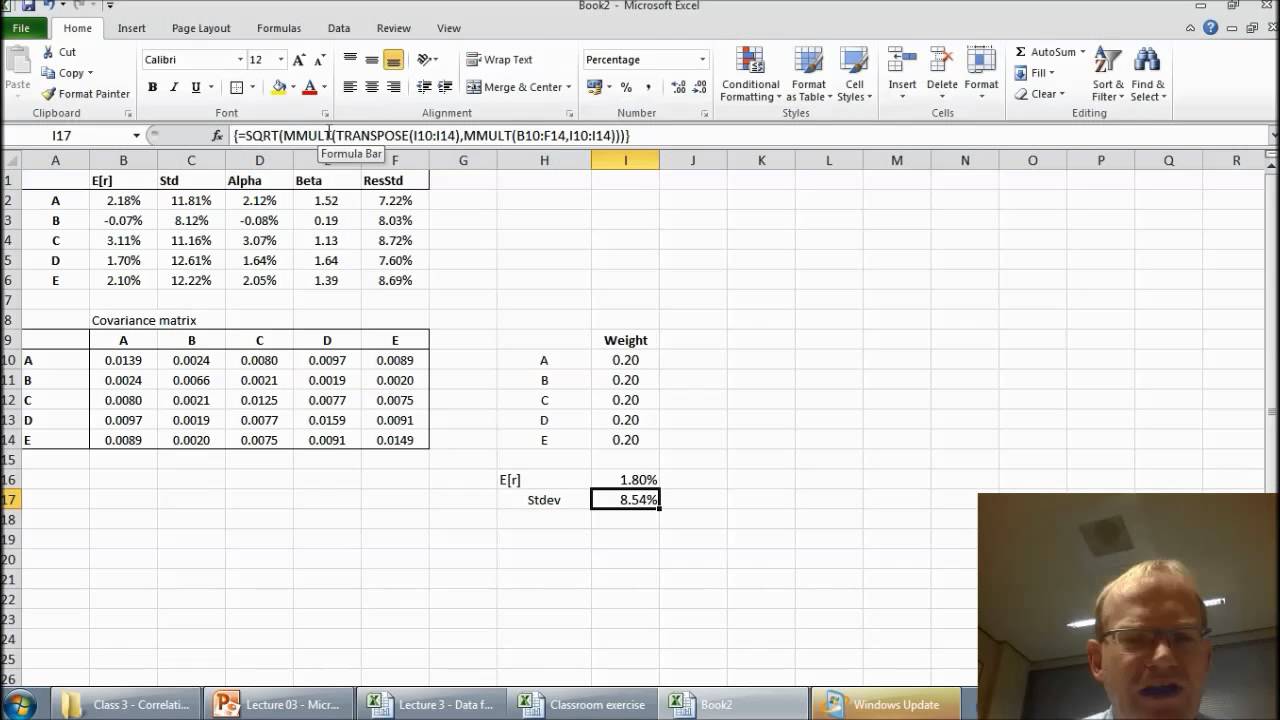

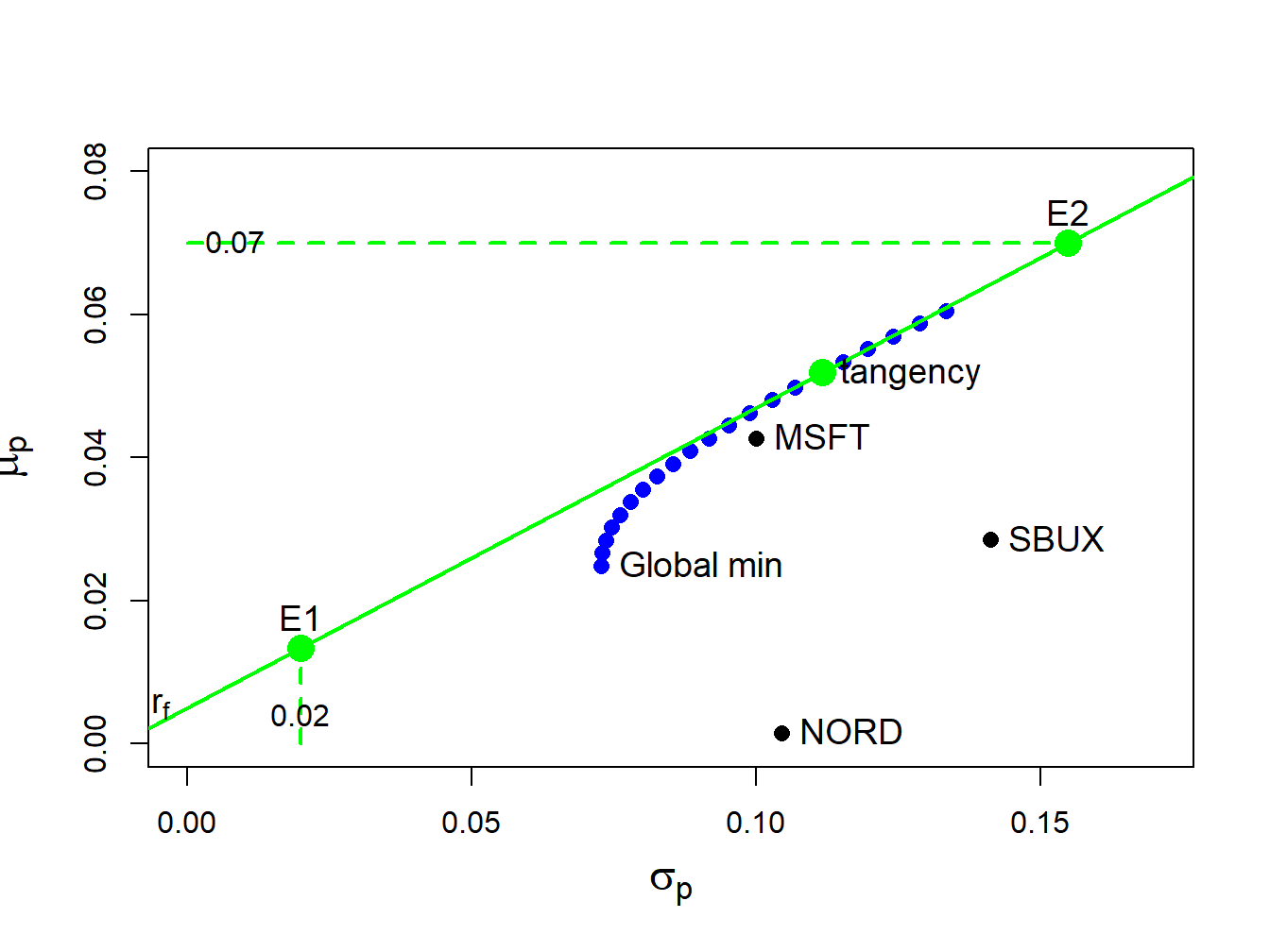

12 Portfolio Theory with Matrix Algebra | Introduction to Computational Finance and Financial Econometrics with R

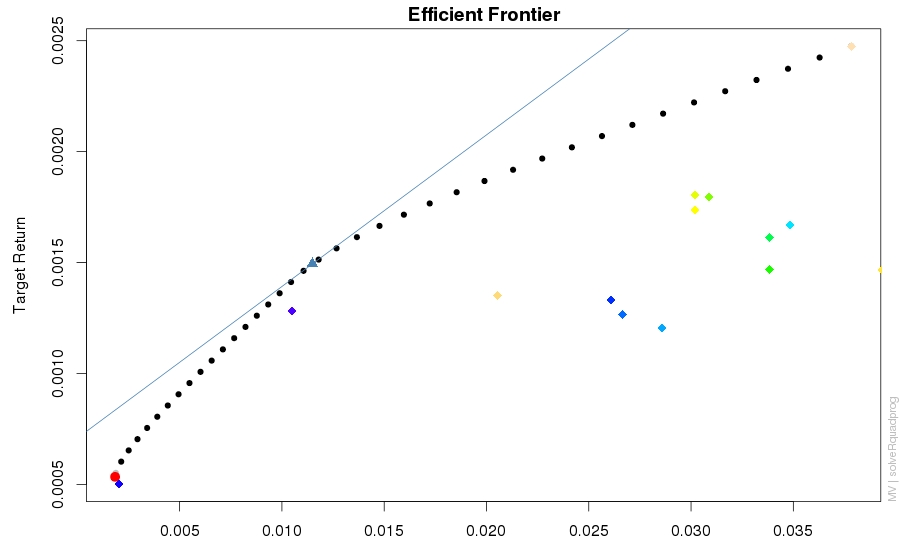

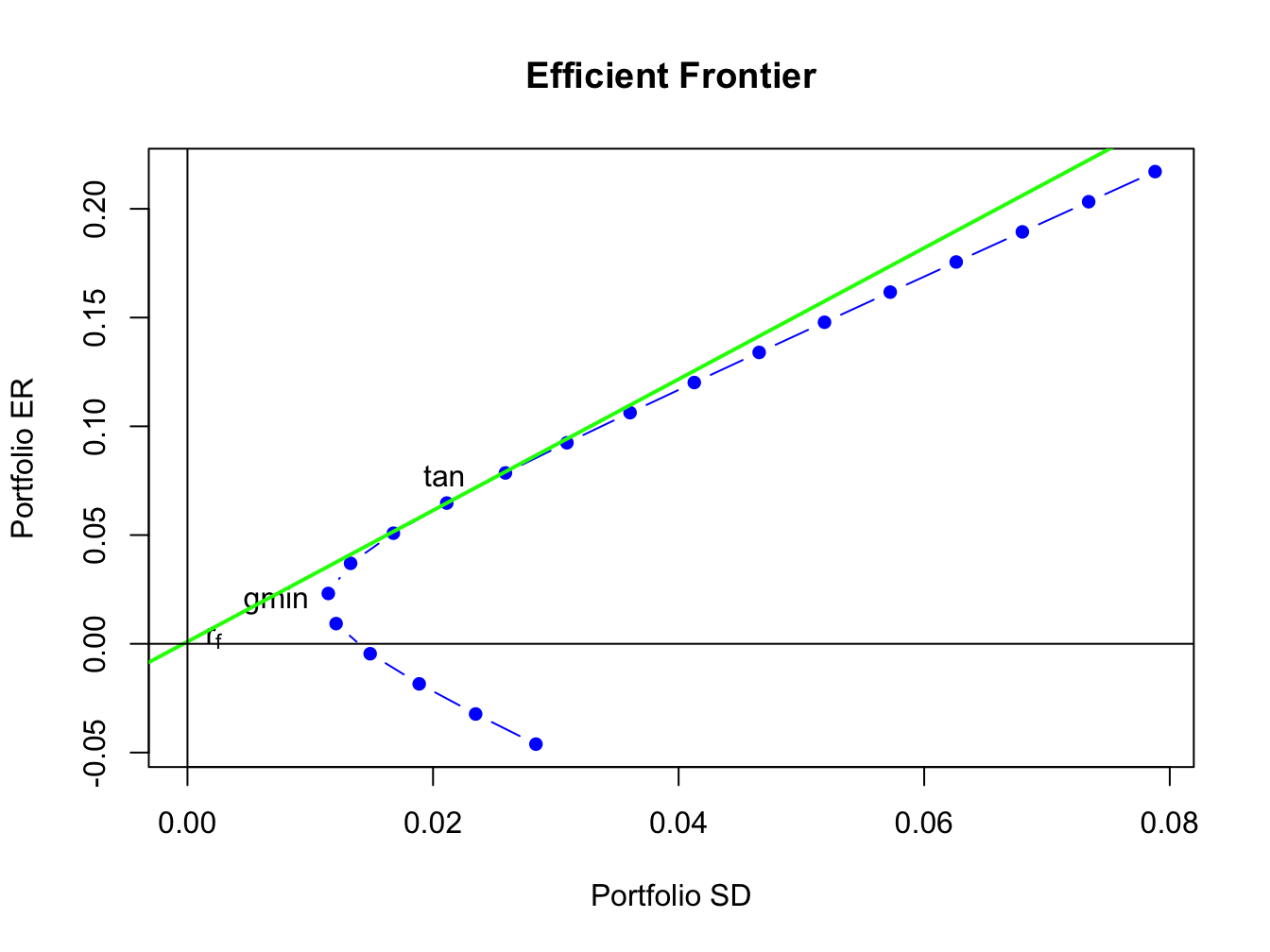

12.5 Computing Efficient Portfolios of N risky Assets and a Risk-Free Asset Using Matrix Algebra | Introduction to Computational Finance and Financial Econometrics with R