A Record 19 Million Americans Asked the IRS for Tax Extensions. It Wasn't Just Procrastination. - WSJ

Sen. Warren wants to expand IRS powers beyond the Inflation Reduction Act to prepare tax returns | Fox Business

House Republicans pass legislation trying to block new IRS funding | Western Iowa Today 96.5 KSOM KS 95.7

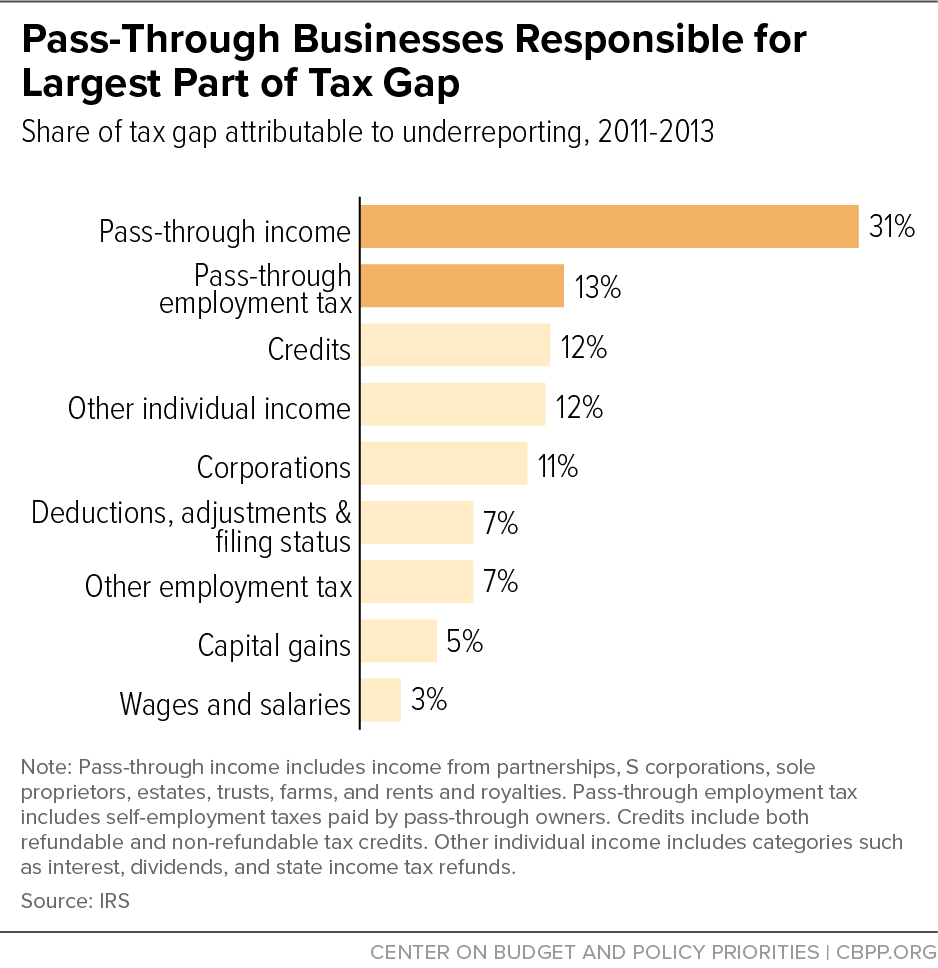

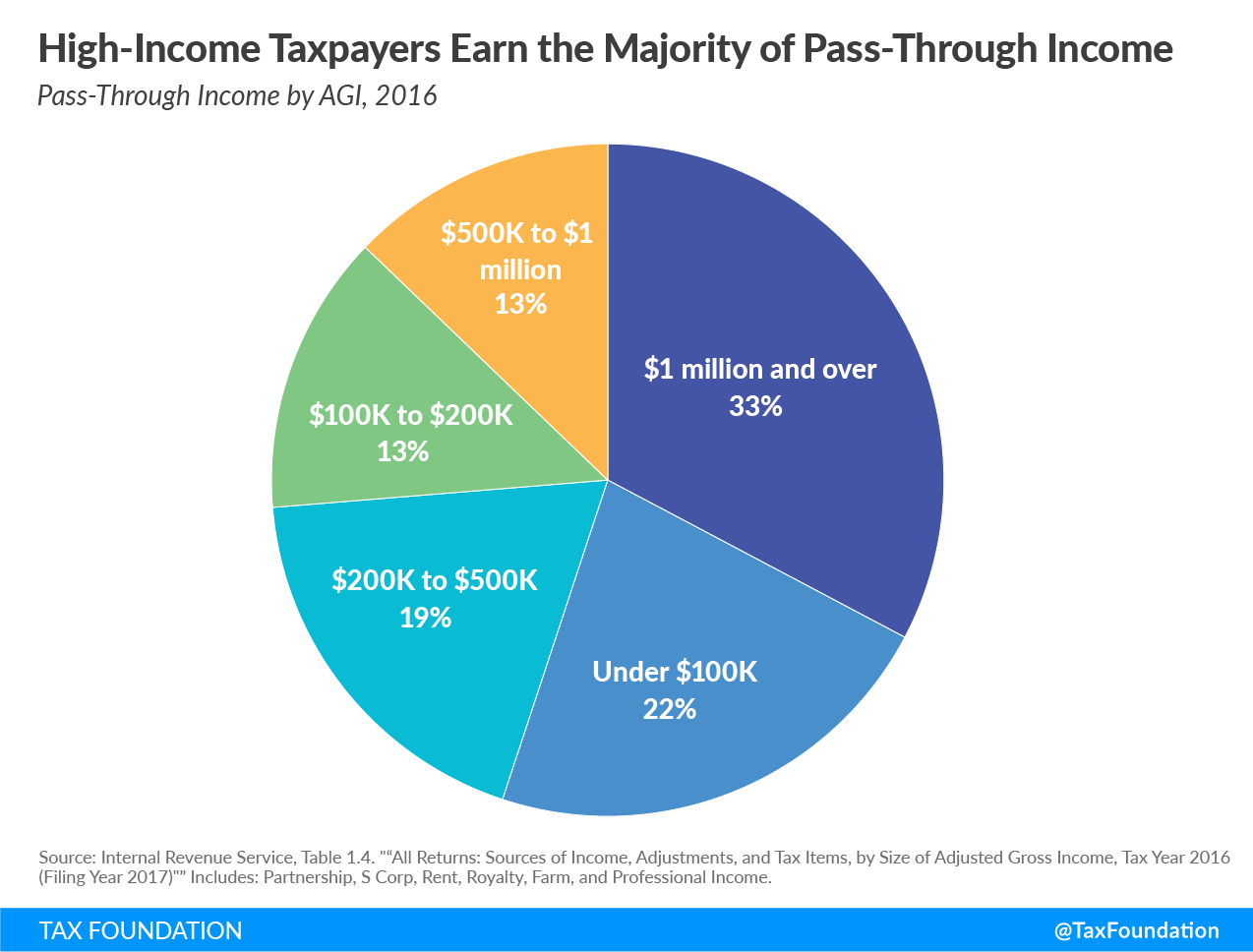

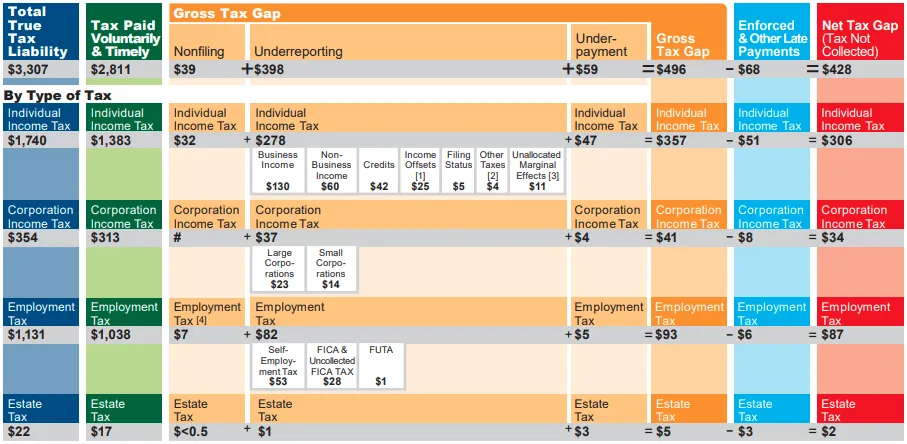

Michele Weiss to Present “IRS & Pass-Throughs: New International Reporting Rules and Enforcement” to the CLA, Tax Section, Women in Tax Committee

IRS kicks off 2020 tax filing season with returns due April 15; help available on IRS.gov for fastest service - Eagle Pass Business Journal